Kelly Formula

Bettors should always look for a mathematical edge rather than rely on their impulses. Learning how to use the Kelly Criterion, for example, is a great way for bettors to determine how much they should stake. Read on to find out.

Prior to placing a bet bettors should consider six important questions: who, what, when, where, why and how? But for this article, it is the how, as in how much to bet, we are interested in.

Kelly Formula Stock

The Kelly Formula was created to help calculate the optimal fraction of capital to allocate on a favorable bet. It doesn't mean that the formula is the be-all-end-all solution, but it. Understanding the Kelly Criterion. Investors often face a tough decision when trying to decide how much money to allocate, as staking either too much or too little will result in a large impact either way. The Kelly criterion is a money-management formula that calculates the optimal amount to ensure the greatest chance of success.

Kelly Formula Pdf

Popular staking method which suggests that stake should be proportional to the perceived edge.

Consider placing a bet on the English Premier League. We can adapt these questions accordingly:

- Who to bet on? Manchester United

- What to bet on? Top 4 finish

- When to bet on? Now

- Where to bet on? Pinnacle tend to offer the best odds

- Why to bet on? They seem to be under-priced

- How much? How much to bet on this outcome?

Most articles focus on the first five questions, typically using mathematical or statistical justifications on answering ‘why’ - such as the article on how to use Monte Carlo methods.

In making financial decisions, the key issue is not only finding the adequate financial products to invest in but also deciding how to subdivide one’s portfolio. Similarly, an important question for a bettor, is how much to wager?

Many papers recommend using the Kelly Criterion or a derivative of it - such as my 2013 paper appearing in the The Journal of Gambling Business and Economics. In essence, the Kelly Criterion calculates the proportion of your own funds to bet on an outcome whose odds are higher than expected, so that your own funds grow exponentially.

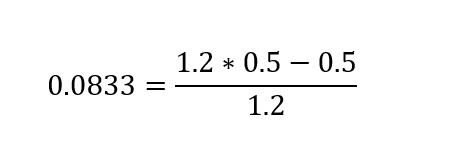

B = the Decimal odds -1

P = the probability of success

Q = the probability of failure (i.e. 1-p)

Using a coin as an example of Kelly Criterion staking

For example, consider you are betting on a coin to land on heads at 2.00. However, the coin is biased and has a 52% chance of ending up on heads.

Kelly Formula Investing

In this case:

P= 0.52

Q = 1-0.52 = 0.48

B = 2-1 = 1.

This works out at: (0.52x1 – 0.48) / 1 = 0.04

Therefore the Kelly Criterion would recommend you bet 4%. A positive percentage implies an edge in favour of your bankroll, so your funds grow exponentially. You can also test the criterion for different values in this online sheet by using the code below.

Ultimately the Kelly Criterion offers a distinct advantage over other staking methods such as Fibonacci and Arbitrage methods as there is a lower risk. However, it does require precise calculation of the likelihood of an event outcome, and discipline of this method will not provide explosive growth of your bankroll.

Keep up-to-date with more top-notch betting articles by following us on Twitter @PinnacleSports.